Insights from Q2 2023 Property Sentiments Report with Mish Daniel & Mark Navin

by Mish Daniel | Free Information

This month, we partnered with Mark Navin, a renowned residential property expert and experienced buyers agent, for an in-depth discussion on the Property Sentiments report for the second quarter of 2023. Published in the Australian Property Investor magazine.

Mark’s insightful analysis on residential trends, helped us gain insight into their impact on the commercial real estate market. After all, what happens in the residential sector sets the course for the commercial sector.

In this post, we highlight some of the key findings but make sure to watch the video for further insights.

Listen to the full conversation below, or keep reading.

The review comprised 735 subscribers, including investors, non-investors, and those with a general interest in the subject.

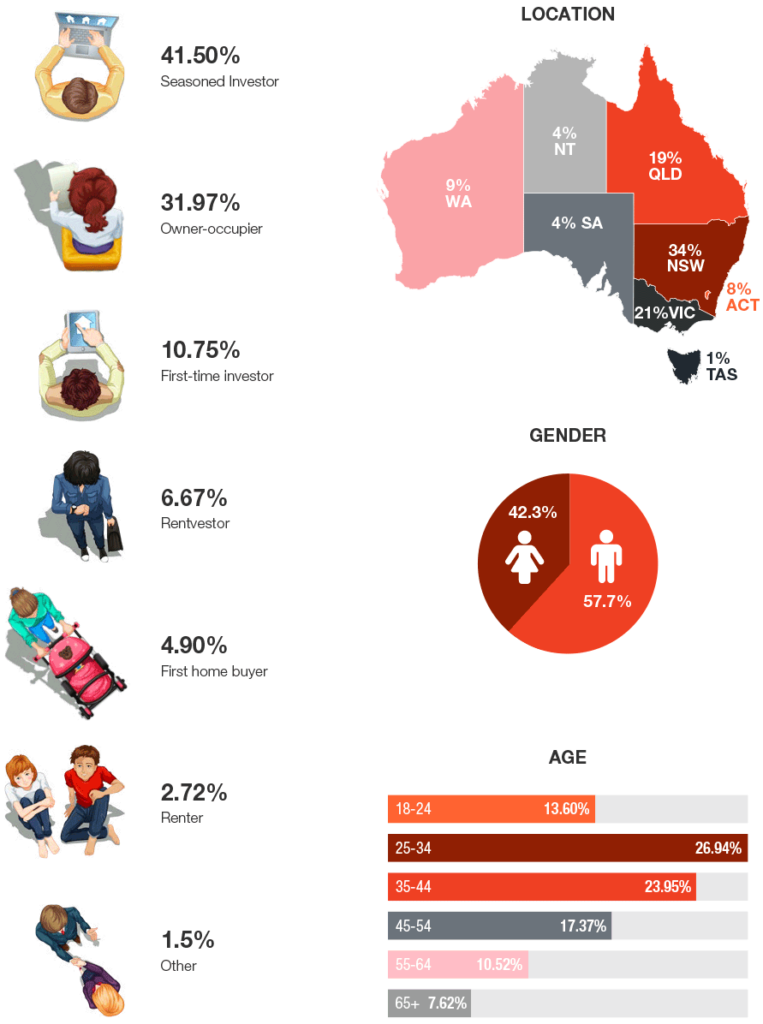

- 41.5% are seasoned investors associated with the Australian Property Investor Magazine.

- Owner occupiers make up 31.97% of the respondents, while first-time investors represent 10.75% – indicating a significant increase compared to previous years.

- Rent investors account for 6.67% of the respondents, showing a notable presence.

- In contrast, the percentage of first-time home buyers is relatively low at 4.9%, possibly due to entry barriers.

- 2.72% are renters, while the rest fall under the “others” category.

The majority of these statistics are derived from:

- New South Wales (34%)

- Victoria (21%)

- Queensland (19%)

- Tasmania and the Australian Capital Territory make up 9% and 8% respectively, considering their smaller size.

Males make up 57.7% of the total, while females make up 42.3%. Female representation has increased noticeably in recent years, with involvement from various age groups, including a significant number of young investors aged 25 to 34 who are entering the market early.

There has been a clear change in focus, as interest in townhouses and units has declined. Recent statistics show a notable increase in preference for houses, with 37% of respondents now favouring houses compared to the previous 21%.

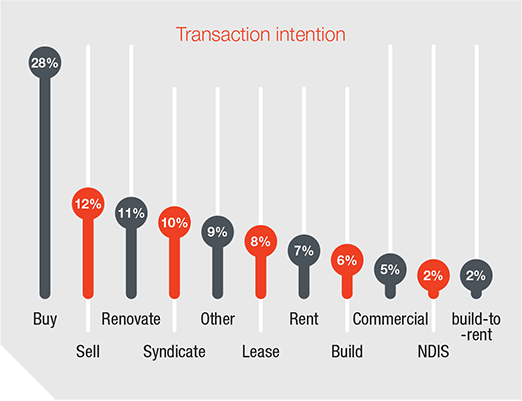

The Transaction Intention chart shows a higher rate of buyers than sellers, creating strain in housing and the commercial sector. Renovation flip deals are popular at 11% of transactions. Syndicates are gaining traction, particularly in commercial properties. Residential transactions continue to dominate with 28% more buyers than commercial ones.

The residential market is currently experiencing a lull, with homeowners hesitant to sell, limiting options for potential buyers. Latest stats show commercial sellers have dropped from 10% to 5%, leading to a surge in demand. Many investors are vying for a piece of this market, and properties that do become available receive multiple offers. Additionally, due to economic turbulence, a significant 30% of sellers or property owners are not making any moves at all.

Price and Predictions

Interest rates and financial accessibility are significant concerns. About 46% of individuals said that interest rates have influenced their buying decisions. With rates rising from 0.25% to 1%, a growing number of buyers (29% of them) are being affected.

- 71.8% of people believe that interest rates will rise

- 11.5% anticipate a decrease

- 16.7% expect rates to remain steady

This positive sentiment has the potential to become self-fulfilling as more people buy into the upward trend and secure financing, driving property prices higher.

Overall, 49.8% of people express a positive outlook on the Australian property market, while 20.3% hold a negative outlook.

Landlords Behaviour

68% of landlords prioritise retaining good tenants over maximising rental returns, while only 32% opt for the latter. It’s a smart choice to keep reliable and trustworthy tenants by offering fair rent increases and ensuring their satisfaction. This increases the chances of long-term stay and helps maintain financial stability by avoiding vacancy periods, re-letting fees, and cleaning expenses. In the end, having good tenants who pay on time and take care of the property is what really matters.

Households Under Mortgage or Rental Stress

The statistics regarding households experiencing mortgage or rental stress indicate that 56% of respondents have indicated no issues, while 36% have confirmed facing stresses, with 8% expressing uncertainty.

Property Price Sentiments and Predictions

There is a generally positive outlook on the property market. Expectations point to a rebound in property prices in most capital cities, wiping out annual losses. National property prices are predicted to rise by 72%, while 55% anticipate an increase in regional prices.

The government is making efforts to tackle the shortage of new properties being built. While a shortage still exists, improvements are underway.

Investor Concern and Finance

The lending scene remains uncertain with fluctuating rates, rising building costs, and investor concerns. Banks are adjusting rates, policies, and commitments, while the new build sector is seeing a significant decline. Increasing material costs have sparked fear and slowed down construction activities. So, more people are choosing to purchase existing homes, adding pressure to the market. These factors have led to a general market slowdown.

Affordability Concerns

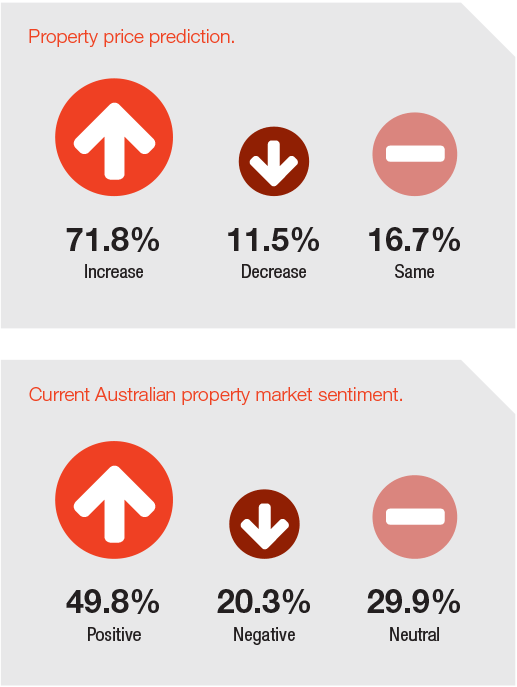

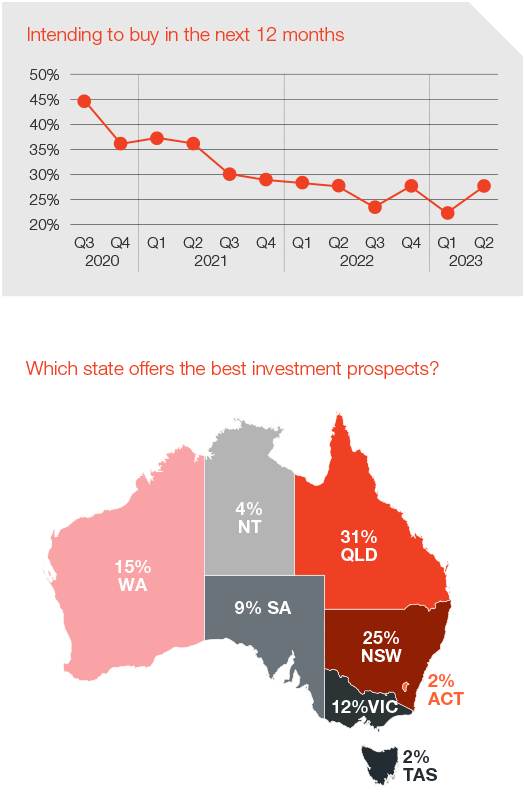

There was a significant increase in the affordability market from 2020 to 2021, followed by a gradual decline in 2022. However, a resurgence became evident in the fourth quarter of 2022 and into 2023.

Affordability concerns vary across sectors, with the housing market and owner-occupied properties being the primary focus. Despite this, many eager buyers are unconcerned about affordability. The limited market supply drives price increases during buyer competition.

In light of these factors, banks should consider relaxing lending rates regardless of interest rates.

Positive Property Market Sentiment

Positive property market sentiment has been on the rise since 2021, reaching close to 70% and is currently standing at 50%. It shows the market is still optimistic and this sentiment should be expected to continue for a few more years.

Investor Intentions and Property Type

Queensland has become a highly desired property investment destination, boasting a promising 31% investment prospects rating. In addition to winning the bid for hosting the Olympics, it offers appealing rental yields. The Olympics will not only bring attention for two weeks but also create job opportunities in venue construction and transportation upgrades. Queensland stands as a beacon of opportunity, ready to shine in the investment landscape.

Purchase Capacity the next 12 months

Looking ahead to purchase capacity in the next 12 months:

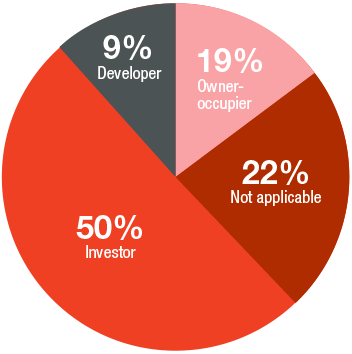

- 50% of respondents are investors, displaying their keen interest in acquiring properties.

- The market keeps attracting more individuals searching for their dream homes and investment properties.

- 22% found the question not applicable, indicating a diverse range of perspectives.

Types of Assets Buyers are Considering

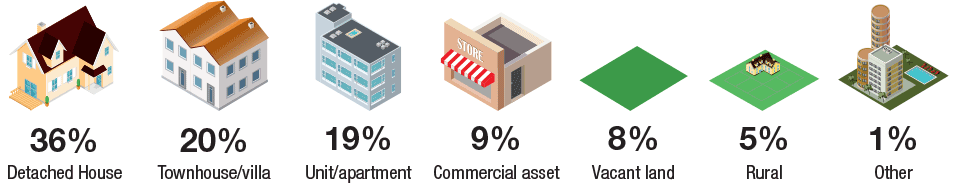

Buyers are considering the following types of assets:

- 36% are eyeing standalone detached housing

- 20% are looking at townhouses

- 19% are interested in apartments and units

- 9% are considering commercial assets

- 8% are considering vacant land

- 5% are considering rural properties

- 1% falls into the “other” category.

It’s clear that the market isn’t one-size-fits-all, with many people interested in investing in various property types of assets.

We hope that you found these statistics enlightening, and that it will help you make your investment decisions.

Remember, we’re here to help you succeed in the world of commercial real estate.

If you have any questions – book a no obligation 15-minute chat with one of our experts at Revolve Commercial. In this call, we’ll address your questions and map out what your potential next steps are to growing your wealth portfolio.

Don’t wait – book your free call today