Maximising Your Commercial Real Estate Returns: Cheatsheets for Crunching the Numbers

by Mish Daniel | Free Information

To successfully achieve positive commercial real estate returns, you not only need to evaluate the location and structure of the property. You also take a deep dive into the financials. This includes metrics like cash flow, return on investment, and profitability.

In our latest video, Mish Daniel shared her expertise on the importance of crunching the numbers in commercial real estate and how to use spreadsheets to make informed decisions.

Mish is the founder of Revolve Commercial, and her 35 years of experience in the industry provide valuable insights on making the numbers work for you.

Listen to the full conversation below or keep reading!

It’s ALL about the numbers for commercial real estate returns

Whether you’re dealing with agents or looking at properties, paying attention to the details is crucial for success. By drilling down on the numbers and doing your due diligence, you can make informed decisions and avoid costly mistakes.

We have a variety of cheat sheets available that you can use – designed to make your life easier.

For a deeper understanding of how our cheatsheets work, and to see the numbers and calculations in action, watch our YouTube video above, or keep reading.

You can also download the Spreadsheet shown here.

Yield and Reversal Yield

The first step in commercial property investing is to calculate your yields.

With this tool, you can play around with different numbers to determine the yield in different scenarios. For example, if you have a property with a rental income of $200,000 and a cap rate of 6%, the value of the property should be $3,333,333 million. But if you want to buy it at a 7% cap rate, the asking price should be $2,857,143 million.

You can customise the numbers to fit your specific situation and see how they affect the yield. This will give you useful information to make a decision.

Equity, Budget, and Cashflow

This tool provides a simple and effective way to calculate key metrics for commercial property investment, such as budget, rental income, and cash flow.

- Equity: The portion of a property’s value that is not mortgaged or subject to third-party interests.

- Budget: The maximum amount of funds available for property purchase or investment.

- Cash Flow: The net income generated by a property after deducting all expenses

By inputting your own numbers and adjusting the metrics, you can quickly evaluate the feasibility of a potential investment and determine if it meets your criteria. For example, $400,000 in equity, shows a budget of $1,333,333 million and a potential rental income of $93,333 resulting in a $40,000 cash flow.

You can adjust the numbers as needed and evaluate different investment scenarios to decide if a property is a good investment opportunity.

To help keep your calculations on track, you can use the Cashflow Projection Spreadsheet.

Everything is already worked out for you. You just need to input your information (that you’ll mainly get from the lease).

By carefully checking the numbers, you can make smart decisions about your property’s potential yield, including the cap rate, cash flow, and cash on cash return. For example, if your tenants have been there for two out of five years, they should have had one incremental rent increase.

You can also see the rate per square meter, monthly payments, mortgage cash reserve needed, and debt recovery ratio.

This will help you make informed investment decisions and highlight anything you need to investigate further.

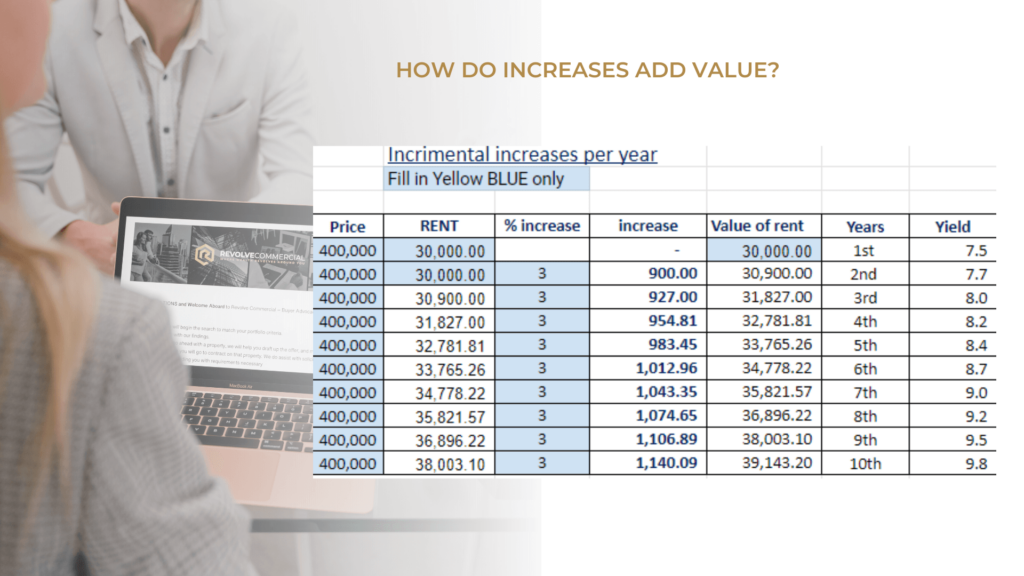

Incremental Increases per Year

This tool helps you calculate the incremental rent increases for your property over time. It’s especially useful for properties that may have rent increases due in the future.

You can input the property price, current rent, and the percentage for incremental rent increases. The spreadsheet then calculates the projected rental income for each year, allowing you to see how the property’s yield changes over time.

This information is crucial when deciding whether to keep or sell the property and can also be helpful when negotiating rental reviews with tenants.

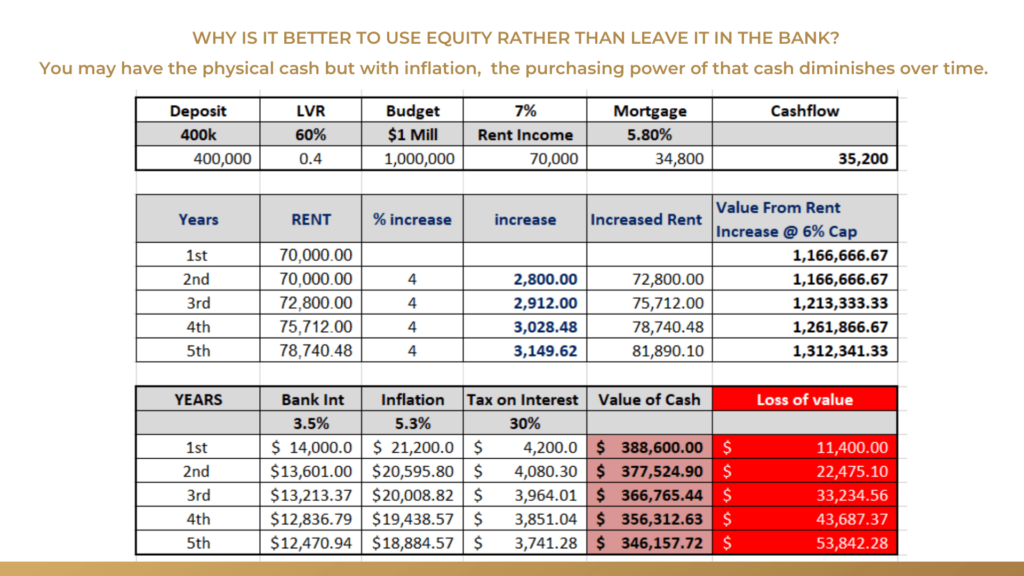

Why It’s Better to Use your Equity

This spreadsheet clearly shows you why it’s better to use equity rather than leave it in the bank. It shows that with inflation, the purchasing power of cash diminishes over time.

When you invest your equity into a commercial property or an income-generating property, you can earn higher returns than what the bank can offer. By doing so, you can generate a steady stream of passive income, that can provide long-term financial stability.

Additionally, investing in real estate provides you with the potential for capital appreciation. Over time, your property’s value can increase, allowing you to build significant wealth.

For instance, let’s say you have $400,000 in cash, sitting in the bank. That may look like a good thing, but in reality, you’re actually losing money due to inflation and taxes. Instead, you should consider investing that money into a commercial property that generates income.

If you invest that money into a property with an LVR of 70%, your rental income increases to $72,800 and the value of your property increases from $1 million to $1,166,666.67 million. And by year five, your rental income would increase to $81,890.10 with a property value of $1,312,341.33 million.

As you can see our spreadsheets are useful tools to help you evaluate potential investments and maximise your commercial real estate returns.

—-

Remember, we’re here to help you succeed in the world of commercial real estate.

If you have any questions – book a no obligation 15-minute chat with one of our experts at Revolve Commercial. In this call, we’ll address your questions and map out what your potential next steps are to growing your wealth portfolio.