Fight Financial Erosion: How To Keep Your Money From Losing Purchasing Power

by Mish Daniel | Free Information

We all want our money to work smarter, not harder. But without the right strategy, inflation can eat away at your cash.

Sure, keeping money in the bank feels safe. But inflation slowly shrinks its value, so your dollars buy less over time.

The good news? Investing gives your money a chance to grow faster than inflation. Options like shares and property can help your money work smarter against those rising prices.

In our latest video, Mish Daniel and finance expert James Wrigley (from First Financial) unpacked their key tips to fight financial erosion by beating inflation and ensure your cash keeps its spending power.

Listen to the full conversation below, or keep reading.

Making Your Money Work for You

For your money to work for you, there are three ways to invest:

- Investing in real estate (residential or commercial)

- Keeping your cash in the bank

- Investing in the share markets

It’s all about finding the perfect match for you because they each have advantages and disadvantages.

Investing has the following benefits:

Compound Interest:

Refers to the concept of earning interest on top of the interest you’ve already earned.

And even though investment gains may seem small at first they build slowly over time and your money can grow exponentially in the long run.

So the sooner you can start investing the better.

Because it’s all about what your investment will be worth 10 or 15 years from now. That is where the money is made!

Diversification:

Diversification mitigates risk by spreading investments across various assets and markets. This balances your portfolio, limiting exposure to any one segment.

A carefully planned, diversified strategy can enhance returns while safeguarding against unpredictable conditions. Implementing diversity provides stability amid market fluctuations.

Real Estate Investment:

Real estate investment builds wealth through rental income and property value appreciation.

Research shows real estate consistently grows in value across entities, making it a reliable strategy. Banks also favour property lending, providing accessible financing.

Top investors like Warren Buffett favour real estate for its potential steady returns. The income and leverage make it an appealing investment vehicle.

Structured Borrowing

If you’re considering borrowing money for your investment, take the time to plan well.

This will set you up for investment success, as borrowing is just as crucial as investing.

It’s a good idea to consult a professional because it’s not only about the loan amount the bank is willing to provide. Here are four things to keep in mind:

Tailored Plans:

Customised borrowing strategies lead to investing success.

Different lenders have varying rules for lending, so it’s crucial to familiarise yourself with the details of any agreement before signing it.

Tailor your plans to align with your specific needs.

Experts can help you to structure financing in a way that benefits you and aligns with your unique needs and goals.

Asset Leverage:

You can use assets like property as collateral for bigger loans to invest with – this ramps up your investing power. But take time to count the costs of fees that come with leveraging assets. Work with pros to leverage in a strategic way that pays off for your goals. Smart asset leverage can take your investing to the next level.

Risk Management:

Maintain a slush fund that serves as a financial cushion in case the market turns down. You should also establish backup investment plans you can activate if conditions become unfavourable. Managing risks proactively in this way provides stability and flexibility to navigate market uncertainty.

Tax Efficiency:

Consider all the tax advantages available to you, as they can save you a lot of money in the long run. A financial planner can help you to do this effectively.

Other Ways to Access Funds

Equity release:

Instead of borrowing money in the conventional sense, you can release the stored equity from your property. This method has become increasingly popular as a flexible way to access the value stored in your property.

The amount you can release is based on your property’s value and the portion that you own.

You can choose how you receive the funds: whether it’s a one-time lump sum or smaller payments over time. Repayment is typically required when you sell the house, move out, or pass away. The repayment amount will typically include the original borrowed amount plus any accumulated interest.

Self-Managed Super Fund (SMSF):

A Self-Managed Super Fund comes with strict regulations and is a flexible way of investing your retirement savings in property.

By setting up a SMSF, you gain more control over your investment decisions.

Ensure you approach SMSFs with informed caution to make them benefit you. There are many things to consider so you should seek expert advice to set it up correctly and to comply with regulations.

Auditors inspect SMSF yearly to make sure it adheres to all the rules. And if you don’t comply, you risk facing significant penalties, hefty tax fines, or even legal action.

Maximising Your Investment Strategy:

Don’t let fluctuating interest rates keep you from investing.

Maximise your investment strategy and don’t let anything stop you from making smart money decisions. Here’s how:

- Assess your financial standing, goals, and objectives.

- Seek professional advice tailored to your situation.

- Determine your strategy based on your objectives and expert recommendations.

- Implement your strategy with a detailed action plan.

- Continuously monitor, adjust, and learn as market conditions change.

How Your Money Can Work for You By Investing in Commercial Property

Let’s look at an example of how your money can work for you by investing it in commercial property:

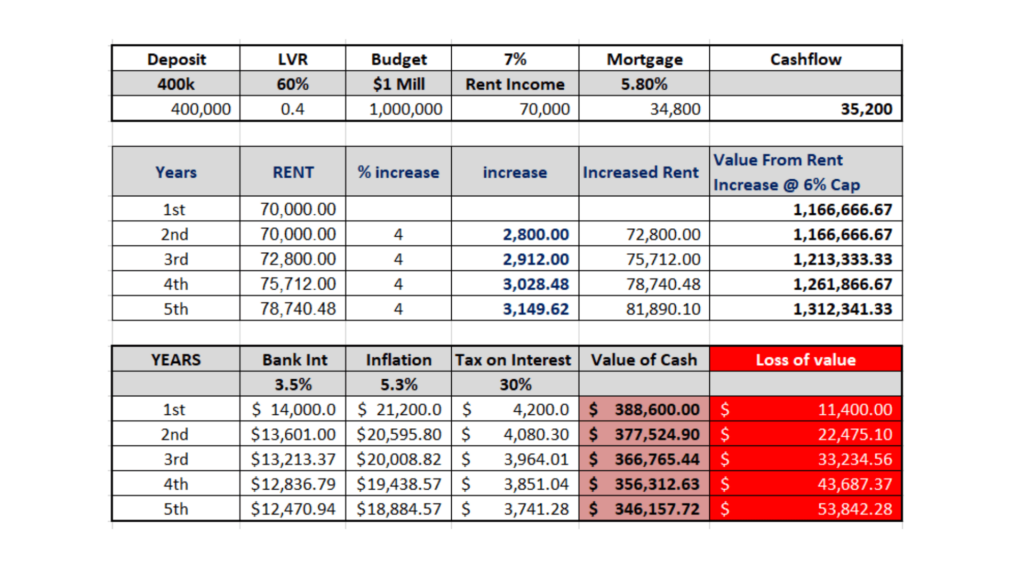

If you paid a deposit of $400,000 on a property of $1 million and a rental income of 7%, you’ll get a rental income of $70,000. Which means you would be earning $35,200 per annum.

And within three years, that property could be worth an estimated $1.213 million.

If you kept the same $400,000 in a bank account then with inflation and tax, by the 5th year you would have only accrued an estimated $53,842.28 compared to $1.213 million if you invested it in commercial property.

This clearly shows how investing in commercial property can offer significant returns and help you to build your wealth.

With the right information and guidance, you can make smarter investment decisions and enjoy greater returns in the long run.

If you need a deeper understanding or tailored advice for your specific financial needs – visit the First Financial website or follow James on his social media channels (he is always doing something exciting on TikTok).

Remember, we’re here to help you succeed in the world of commercial real estate.

If you have any questions – book a no obligation 15-minute chat with one of our experts at Revolve Commercial. In this call, we’ll address your questions and map out what your potential next steps are to growing your wealth portfolio.

Don’t wait – book your free call today